Generous individuals desire to make a constructive impact on the world through charitable giving. ,Moreover, strategic donations can offer significant tax advantages, leading to a more optimal philanthropic strategy. By understanding the nuances of fiscal laws and regulations governing charitable contributions, you can increase your contribution while lowering your tax liability.

- Consult with a qualified tax advisor to figure out the best strategies for your unique circumstances.

- Research charitable organizations thoroughly to ensure your donations are directed towards noble causes that align with your values.

- Record all your charitable contributions meticulously, as this documentation is crucial for deducing the associated tax benefits.

Smart Giving: Donate and Reduce Your Tax Burden

Charitable giving is a rewarding experience that allows you to contribute to causes you care about. Additionally, savvy donors understand that strategic philanthropy can also minimize their tax obligation. By strategically planning your donations, you can optimize the impact of your generosity while also gaining potential tax savings.

- Consult a qualified tax professional to determine the best strategies for your unique situation.

- Explore various charities that align with your values.

- Think about different types of gifts, such as money, securities, or planned giving.

Benefit from Tax Deductions for Charitable Contributions: A Guide

Planning to contribute to a worthy cause? You may be able to lower your tax bill by claiming a deduction for your charitable contributions. However, the rules can be complex and it's important to understand the guidelines before you file your taxes.

Here are some key points to keep in mind:

* You can generally deduct cash donations, barter Tutorial donations, and donations of property.

* For cash contributions, you'll need a acknowledgement from the charity.

* For non-cash donations, you'll need to estimate their value.

* The amount you can deduct is usually limited to a percentage of your adjusted gross income.

* There are special rules for donations to charities.

It's always best to speak with a tax professional for personalized advice. They can help you maximize your deductions and ensure that you comply with all applicable laws.

Give Back and Save on Taxes: The Power of Charitable Donations

Looking to give back to your community while also optimizing your finances? Charitable donations can be an incredibly powerful tool to {achieve both goals|. Make a positive impact and enjoy valuable savings. By contributing to organizations that align with your values, you can make a real impact while simultaneously reducing your tax burden.

- Uncover a world of impactful causes

- Learn about potential deductions

- Partner with professionals to optimize your charitable giving strategy

Don't miss out on this incredible benefit to give back and save.

Maximizing Your Impact Through Charitable Giving

Strategic giving extends beyond simply donating to causes you care about. By thoughtfully designing your charitable contributions, you can unlock significant tax advantages. This methodology allows you to increase your impact while also minimizing your tax burden. A skilled financial advisor can advise you in developing a personalized giving plan that aligns with your philanthropic goals and financial objectives. By leveraging the power of strategic giving, you can create a win-win scenario where your generosity makes a positive difference and your finances benefit as well.

Support Causes You Care About While Saving on Taxes

Combining your passion for philanthropy with smart financial planning is achievable through tax-advantaged donations. By contributing to qualified charities, you can minimize your tax burden while making a positive difference in the world. These incentives allow you to give back causes you care about and gain financial rewards at the same time.

- Discover various charitable donation options like cash contributions, stock transfers, and planned giving.

- Maximize your donations by understanding the deductible limits and requirements.

Tax-advantaged donations offer a win-win opportunity to strengthen communities while streamlining your finances.

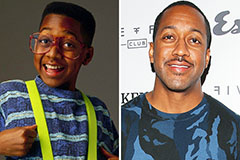

Jaleel White Then & Now!

Jaleel White Then & Now! Shaun Weiss Then & Now!

Shaun Weiss Then & Now! Ashley Johnson Then & Now!

Ashley Johnson Then & Now! Karyn Parsons Then & Now!

Karyn Parsons Then & Now! Justine Bateman Then & Now!

Justine Bateman Then & Now!